Investor Perception

Atlantic Lithium is advancing Ghana’s first lithium mine at Ewoyaa, a completely permitted, strategically positioned undertaking prepared to produce international battery markets. With sturdy native assist and a transparent path to manufacturing, the corporate is positioned for near-term progress and long-term influence within the power transition.

Overview

Atlantic Lithium (AIM:ALL,ASX: A11,GSE:ALLGH,OTCQX: ALLIF) is an Africa-focused lithium exploration and improvement firm advancing its flagship Ewoyaa Lithium undertaking by to manufacturing as Ghana’s first lithium mine.

Regardless of its lengthy mining historical past, beneficial regulatory local weather and steady political backdrop, Ghana stays largely ignored as an funding jurisdiction for battery metals. Located on the West African coast, the nation boasts a robust strategic location, between Europe, the Americas and Asia, to serve the worldwide battery metals market. Ghana can also be dwelling to an abundance of mineral wealth, with c. 180,000 tonnes of estimated lithium assets.

Atlantic Lithium intends to supply spodumene focus able to conversion to lithium chemical substances to be used in electrical automobile batteries and power storage, aiming to assist international decarbonisation.

A definitive feasibility examine (DFS) launched in June 2023 reveals that Ewoyaa has demonstrable financial viability, low capital depth and wonderful profitability.

By means of easy open-pit mining, three-stage crushing and traditional Dense Medium Separation (DMS) processing, the DFS outlines the manufacturing of three.6 Mt of spodumene focus over a 12-year mine life, which is able to make it one of many largest spodumene mines by manufacturing capability globally.

The Ewoyaa Lithium Challenge was awarded a Mining Lease in October 2023, an EPA Allow in September 2024, and a Mine Working Allow in October 2024.

Having secured all the permits required to start development, Atlantic Lithium presently awaits parliamentary ratification of the Ewoyaa Mining Lease, which was issued by the Ministry of Lands and Pure Sources in October 2023.

The JORC mineral useful resource estimate at Ewoyaa now stands at 36.8 million tons (Mt) at 1.24 % lithium oxide, 81 of which is now within the larger confidence measured and indicated classes (3.7 Mt at 1.37 % lithium oxide within the measured class, 26.1 Mt at 1.24 % lithium oxide within the indicated class, and seven Mt at 1.15 % lithium oxide within the Inferred class).

The residents of the project-affected communities in Ghana’s Central Area have voiced their sturdy assist from the development of the undertaking in the direction of manufacturing.

Atlantic Lithium’s Ewoyaa Lithium Challenge website

Challenge Funding

The event of the undertaking is co-funded below an settlement with NASDAQ and ASX-listed Piedmont Lithium (ASX: PLL), below which Piedmont is required to contribute the primary US$70m of Improvement Prices, as outlined within the settlement, as sole funding to finish its earn-in to 50% of Atlantic Lithium’s possession of the undertaking, with all Improvement Prices and different undertaking expenditure equally shared by each Atlantic Lithium and Piedmont thereafter.

In accordance with the settlement, which is meant to end result within the development of the undertaking and the achievement of preliminary spodumene manufacturing, Piedmont will earn the rights to 50 % of all spodumene focus produced at Ewoyaa at market charges, offering a path to shoppers by a number of main battery producers, together with Tesla.

The Minerals Revenue Funding Fund (MIIF), Ghana’s minerals sovereign wealth fund, has additionally agreed to speculate US$27.9 million at project-level to accumulate a 6% contributing curiosity within the undertaking and Atlantic Lithium’s Ghana Portfolio. The project-level funding represents Stage 2 of its Strategic Funding within the firm.

This follows Stage 1 of its Strategic Funding, comprising MIIF’s Subscription for US$5 million Atlantic Lithium shares, which was accomplished in January 2024, leading to MIIF changing into a serious strategic shareholder within the firm.

MIIF’s Strategic Funding is meant to expedite the event of the undertaking in the direction of manufacturing.

As well as, noting that Ewoyaa is likely one of the most superior undeveloped laborious rock lithium tasks globally, Atlantic Lithium continues to have interaction with events throughout the battery metals provide chain who specific inbound curiosity in lithium merchandise from Ewoyaa.

In doing so, Atlantic Lithium goals to expedite and de-risk the event of the Challenge, realise engaging phrases for any offtake contracted and safe well-credentialled companions that can assist the corporate’s and Ghana’s aims of supplying lithium into the worldwide market.

Ghana

Ghana is a well-established mining area with entry to dependable, current infrastructure and a major mining workforce. There are presently 16 working mines within the nation.

Already the biggest taxpayer and employer in Ghana’s Central Area, Atlantic Lithium is predicted to supply direct employment to over 900 personnel at Ewoyaa and, by its group improvement fund, whereby 1 % of revenues will likely be allotted to native initiatives, will ship long-lasting advantages to the area and Ghana.

By means of its confirmed lithium discovery, exploration and analysis methodologies, Atlantic Lithium has the potential to capitalise on its intensive exploration portfolio and ship upon its aims of changing into a number one producer of lithium in West Africa.

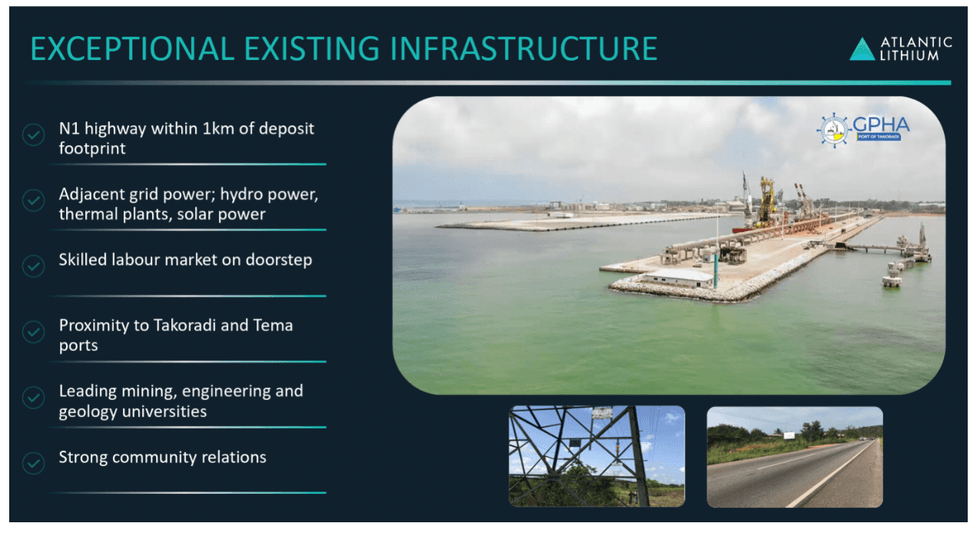

Atlantic Lithium’s flagship Ewoyaa Lithium Challenge is located inside 110 kilometres of Takoradi Port and 100 kilometres of Accra, with entry to wonderful infrastructure and a talented native workforce.

Atlantic Lithium has been granted a Mining Lease, an EPA Allow and a Mine Working Allow in respect of the undertaking in October 2023, September 2024 and October 2024, respectively. The corporate is presently advancing the undertaking in the direction of manufacturing.

Highlights:

- Promising DFS Outcomes: Atlantic Lithium’s DFS reaffirmed Ewoyaa’s low capital and working profile and strong profitability. Highlights embody:

- Estimated 12-year lifetime of mine, producing 3.6 Mt spodumene focus.

- 365 ktpa regular state manufacturing

- Sturdy US$675/t All in sustaining price and US$377 C1 money price.

- Beneficial Location: The undertaking’s starter pits are positioned inside one kilometre of its processing plant. Moreover, Ewoyaa has entry to dependable current infrastructure, positioned inside 800 metres from the N1 freeway and adjoining to grid energy.

- Promising Reserves: Ewoyaa’s present mineral useful resource estimate (as of July 2024) at is 36.8 Mt at 1.24 % lithium oxide, of which 81 % is now within the larger confidence measured and indicated classes (3.7 Mt at 1.37 % lithium oxide within the measured class, and 26.1 Mt at 1.24 % lithium oxide within the indicated class, and seven Mt at 1.15 % lithium within the inferred class).

- Potential for Additional Exploration: There stays important exploration potential inside the firm’s 509km2 tenure in Ghana.

- Robust Partnerships: Atlantic Lithium has an offtake cope with Piedmont Lithium, which itself has offtake agreements with each Tesla and LG Chem. Ghana’s Minerals Revenue Funding Fund has additionally agreed a Strategic Funding within the firm to expedite the event of the undertaking.

- Optimistic Presence: Atlantic Lithium will generate important financial advantages for the area. As soon as operational, the undertaking is predicted to make use of over 900 personnel and ship important worth to Ghana, together with by taxes, royalties, employment and native procurement.

Côte d’Ivoire

Atlantic Lithium wholly owns two contiguous exploration licences protecting an space of c. 771 sq. kilometres within the mining-friendly jurisdiction of Côte d’Ivoire, which borders Ghana on the West African coast. The 2 licences provide the corporate with unique rights to use its confirmed lithium exploration experience over new, untested and extremely potential tenure, the place the corporate considers there to be important lithium discovery potential. The licences, that are positioned inside 100 kilometres of the nation’s financial capital, Abidjan, are extremely well-served, with intensive street infrastructure, well-established mobile community and high-voltage transmission strains.

Administration Group

Neil Herbert – Government Chairman

Neil Herbert is a fellow of the Affiliation of Chartered Licensed Accountants and has over 30 years of expertise in finance. He has been concerned in rising mining and oil and fuel firms, each as an govt and as an investor, for over 25 years.

Till Could 2013, he was co-chairman and managing director of AIM-quoted Polo Sources, a pure assets funding firm. Previous to this, Herbert was a director of useful resource funding firm Galahad Gold, from which he grew to become finance director of its most profitable funding, the start-up uranium firm UraMin, from 2005 to 2007. Throughout this era, he labored to drift the corporate on AIM and the Toronto Inventory Trade in 2006, raised US$400 million in fairness financing and subsequently negotiated the sale of the group for US$2.5 billion.

Herbert has held board positions at plenty of useful resource firms the place he has been concerned in managing quite a few acquisitions, disposals, inventory market listings and fundraisings. He holds a joint honours diploma in economics and financial historical past from the College of Leicester.

Keith Muller – Chief Government Officer

Keith Muller is a mining engineer with over 20 years of operational and management expertise throughout home and worldwide mining, together with within the lithium sector. He has a robust operational background in laborious rock lithium mining and processing, significantly in DMS spodumene processing.

Earlier than becoming a member of Atlantic Lithium, he held roles as each a enterprise chief and normal supervisor at Allkem, the place he labored on the Mt Cattlin lithium mine in Western Australia and, previous to that, Muller served as operations supervisor and senior mining engineer at Simec.

Muller holds a Grasp of Mining Engineering from the College of New South Wales and a Bachelor of Engineering from the College of Pretoria. He’s additionally a member of the Australian Institute of Mining and Metallurgy, the Board of Skilled Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas – Finance Director and Firm Secretary

Amanda Harsas is a senior finance govt with a demonstrable monitor document and over 25 years’ expertise in strategic finance, enterprise transformation, industrial finance, buyer and provider negotiations and capital administration. Earlier than becoming a member of Atlantic Lithium, she labored in a number of sectors, together with healthcare, insurance coverage, retail {and professional} companies, throughout Asia, Europe and the U.S. Harsas holds a Bachelor of Enterprise from the College of Expertise, Sydney and is a member of Chartered Accountants Australia and New Zealand and the Australian Institute of Firm Administrators.

Kieran Daly – Non-executive Director

Kieran Daly is the manager of Development and Strategic Improvement at Assore. He holds a BSc Mining Engineering from Camborne Faculty of Mines (1991) and an MBA from Wits Enterprise Faculty (2001) and labored in funding banking/fairness analysis for greater than 10 years at UBS, Macquarie and Investec, previous to becoming a member of Assore in 2018.

Daly spent the primary 15 years of his mining profession at Anglo American’s coal division (Anglo Coal) in plenty of worldwide roles together with operations, gross sales and advertising, technique and enterprise improvement. Amongst his key roles had been main and creating Anglo Coal’s advertising efforts in Asia and to metal trade clients globally. He was additionally the World Head of Technique for Anglo Coal instantly previous to leaving Anglo in 2007.

Christelle Van Der Merwe – Non-executive Director

Christelle Van Der Merwe is a senior supervisor within the progress & strategic improvement crew at Assore. She has been a geologist for Assore since 2013 and is concerned with the strategic and useful resource funding selections of the corporate. Van Der Merwe is a member of SACNASP, the GSSA and AUSIMM.

Jonathan Henry – Impartial Non-executive Director

Jonathan Henry is an skilled non-executive director, having held varied management and board roles for practically twenty years. Henry has important experience working throughout capital markets, enterprise improvement, undertaking financing, key stakeholder engagement, and the reporting and implementation of ESG-focused initiatives. Henry has a wealth of expertise tasks in the direction of manufacturing and commercialisation to ship shareholder worth.

Henry beforehand served as non-executive chair and govt chair of Giyani Metals Company, a battery improvement firm advancing its portfolio of manganese oxide tasks in Botswana, govt chair and non-executive director at Ormonde Mining, non-executive director at Ashanti Gold Company, president, director and chief govt officer at Gabriel Sources and varied roles, together with chief govt officer and managing director, at Avocet Mining. He holds a BA (Hons) in Pure Sciences from Trinity Faculty, Dublin.

Michael Bourguignon – Head of Capital Tasks

Michael Bourguignon is a distinguished undertaking administration skilled with a wealthy historical past of main important initiatives within the mining and power sectors. Most just lately, he served because the COO at Evolution Vitality Minerals in Tanzania, the place he managed the optimisation and replace of the Definitive Feasibility Research, managed the Entrance-Finish Engineering Design bundle, and oversaw the completion of the Relocation Motion Plan and different community-related works.

Previous to this, Bourguignon labored with Rio Tinto in Australia as a consulting development supervisor, in addition to Glencore’s Mopani Copper Mines in Zambia, the place he was the undertaking director for the Mopani Synclinorium Concentrator, and Syrah’s Balama Graphite Mine in Mozambique, the place he was undertaking director. He has additionally beforehand labored in Ghana and Cote d’Ivoire with Perseus Mining. Bourguignon holds an MBA from Murdoch College and is a member of the Australian Institute of Challenge Administration.

Andrew Henry – Normal Supervisor, Business and Finance

Andrew Henry is an completed normal supervisor with over a decade’s expertise within the operational mining sector, specialising in technique, planning and evaluation, contracts, large-scale undertaking improvement and website operations.

Earlier than becoming a member of Atlantic Lithium, Henry held the position of economic supervisor at international lithium chemical substances firm Allkem and, previous to that, he spent over 4 years with main gold mining firm Newcrest Mining.

Henry holds a Bachelor of Commerce from the College of South Australia and is a member of CPA Australia.

Ahmed-Salim Adam – Normal Supervisor, Operations

Ahmed-Salim Adam is an skilled mining normal supervisor with over 15 years of expertise main varied large-scale tasks in Ghana throughout all phases of mine improvement, manufacturing, and closure, with a deal with security and sustainability.

Adam has beforehand held plenty of management roles, together with as senior guide of Metallurgy at GEOMAN Seek the advice of Ltd, as a director for FGR Bogoso Prestea’s Refractory Challenge and as normal supervisor at Golden Star Sources.

He holds a MPhil Minerals Engineering and a Bachelor of Science (Hons) in Mineral Engineering, each from the College of Mines and Expertise, Ghana. He’s additionally a member of The Institute of Supplies, Minerals and Mining (IOM3) in the UK and the Australasian Institute of Mining and Metallurgy (AusIMM) in Australia.

Belinda Gethin – Normal Supervisor, Company Finance and Firm Secretary

Belinda assumed the position of normal supervisor, company – finance and firm secretary in January 2024, having initially joined the corporate as monetary reporting supervisor in June 2023. To her position at Atlantic Lithium, Gethin brings a wealth of expertise in all facets of statutory, monetary and company reporting, together with the preparation of economic statements and accounting for advanced transactions. Earlier than becoming a member of Atlantic Lithium, Gethin labored because the chief monetary officer for Lumus Imaging and, previous to that, because the group reporting supervisor at Healius. Gethin is a chartered accountant and holds a Bachelor of Commerce from UNSW in Sydney, Australia.

Iwan Williams – Normal Supervisor, Exploration

Iwan Williams is an exploration geologist with over 20 years’ expertise throughout a broad vary of commodities, principally iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE’s, nickel and different base metals, in addition to chromitite, phosphates, coal and diamond.

Williams has intensive southern and West African expertise and has labored in Central and South America. His expertise consists of all facets of exploration administration, undertaking era, alternative evaluations, due diligence and mine geology. He has intensive research expertise, having participated within the supply of a number of undertaking research together with useful resource, mine design standards, baseline environmental and social research and metallurgical test-work programmes. He’s very aware of working in Afric,a having spent 23 years of his 28-year geological profession in Africa. Williams is a graduate of the College of Liverpool.

Abdul Razak – Exploration Supervisor, Ghana

Abdul Razak has intensive exploration, useful resource analysis and undertaking administration expertise all through West Africa with a robust deal with data-rich environments. He has intensive gold expertise, having labored all through Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, in addition to worldwide exploration and useful resource analysis expertise in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an integral member of the crew, managing all website actions together with drilling, laboratory, native groups, geotech and hydro, group consultations and stakeholder engagements and was instrumental inthe institution of the present improvement crew and defining Ghana’s maiden lithium useful resource estimate.