[ad_1]

This text on Buying and selling Sideways Markets is the opinion of Optimus Futures.

Unlocking Alternatives When the Development Goes Nowhere

Image this: you’re watching the markets, ready for that large trending transfer, however as an alternative, costs simply bounce backwards and forwards in what looks as if an infinite ping-pong match. Sound acquainted? Welcome to range-bound markets—some of the frequent but misunderstood market circumstances that futures merchants encounter.

Whereas many merchants sit on the sidelines throughout these “boring” durations, savvy merchants know that sideways markets, or range-bound markets, truly account for roughly 70% of all market circumstances (opinion).

What Precisely Is a Sideways Market?

Consider a sideways market like a tennis match the place the ball retains bouncing between two gamers who by no means miss. In buying and selling phrases, this implies costs transfer inside a comparatively predictable vary, bouncing between a ceiling (resistance) and a flooring (assist) with out breaking decisively larger or decrease.

These durations sometimes occur when the market is digesting info or ready for the following main catalyst. As a substitute of creating dramatic strikes up or down, costs oscillate in a horizontal channel whereas patrons and sellers battle for management.

Right here’s what makes sideways markets distinctive: they typically have clear boundaries that costs respect repeatedly, quantity tends to be comparatively quiet till one thing adjustments, and neither the bulls nor bears can achieve a decisive benefit for prolonged durations.

Why Sideways Markets Are Tradable As nicely

Right here’s a secret that skilled merchants know however newcomers typically overlook: sideways markets could be doubtlessly extra predictable than trending markets. When you understand the place the boundaries are, you’ll be able to plan your trades with higher confidence.

Give it some thought this fashion—in a trending market, you by no means know when the development would possibly reverse or how far it would go. However in a sideways market, you have got clearly outlined revenue targets and threat ranges. It’s like enjoying basketball on a courtroom with clearly marked boundaries versus enjoying on a subject with no traces.

These consolidation durations additionally sometimes happen throughout particular market circumstances. You’ll typically see them after main financial bulletins when establishments are digesting new info, throughout vacation durations when fewer merchants are lively, or between earnings seasons when elementary catalysts are restricted.

Recognizing Sideways Markets

The excellent news is that figuring out sideways markets doesn’t require a PhD in rocket science. With Optimus Circulation’s superior charting capabilities, you’ll be able to spot these alternatives throughout a number of timeframes concurrently.

The Visible Strategy

Begin by taking a look at your charts and asking your self a easy query: “Are costs making larger highs and better lows, or are they caught between two horizontal traces?” If it’s the latter, you’re probably taking a look at a sideways market.

Optimus Circulation comes with over 50 pre-built indicators that may assist verify what your eyes are seeing. Listed below are essentially the most helpful ones for figuring out range-bound circumstances:

- Common Directional Index (ADX): When it drops beneath 25, it typically indicators that the market lacks clear path

- Bollinger Bands: Bands squeezing collectively counsel lowering volatility, frequent in sideways markets

- Quantity Evaluation: Optimus Circulation’s free instruments assist you to spot when quantity drops throughout consolidation durations

Studying the Order Circulation

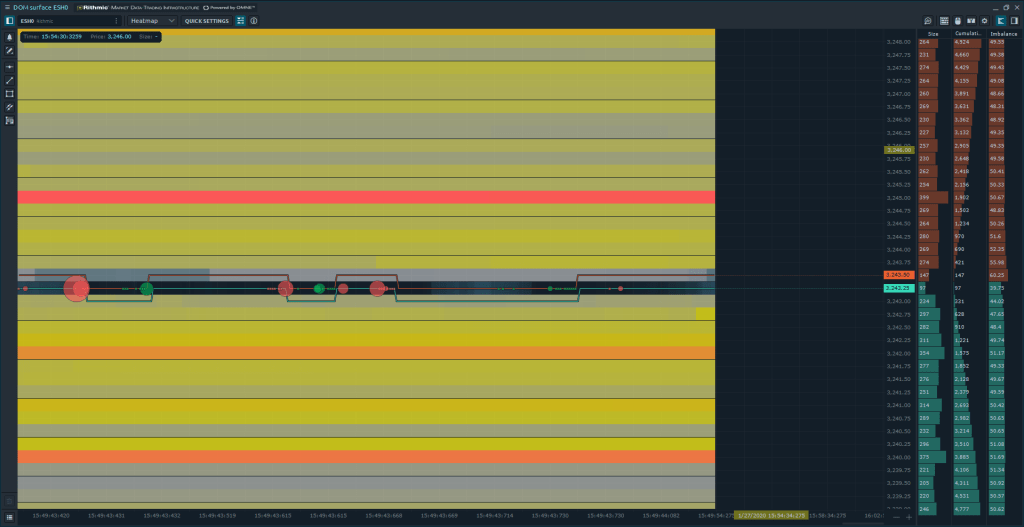

That is the place Optimus Circulation’s distinctive DOM Floor panel turns into invaluable. Not like fundamental charting packages, this characteristic shows all shopping for and promoting exercise in real-time.

In range-bound markets, you’ll discover one thing fascinating: liquidity tends to cluster on the assist and resistance ranges, and you’ll truly see when giant orders are being absorbed with out shifting costs considerably.

The platform’s quantity evaluation instruments (which come free together with your account) assist you to perceive when quantity drops throughout range-bound durations versus when it spikes, doubtlessly signaling an upcoming breakout.

Vary Certain Buying and selling Methods

Technique 1: The Bounce Play – Early vs. Late Entry

That is the bread and butter of range-bound market buying and selling, and it’s easy sufficient for newcomers but refined sufficient for professionals. Nevertheless, timing your entry could make the distinction between constant income and irritating losses.

Disclaimer: The next is a hypothetical instance for academic functions solely and shouldn’t be thought-about a commerce suggestion. All buying and selling entails substantial threat of loss.

Let’s say the E-mini S&P 500 (ES) has been bouncing between 4,200 and 4,250 for 2 weeks. You’ve two most important approaches for timing your entries:

Early Entry Strategy: You enter as costs method the vary boundaries—shopping for at 4,205 (simply above assist) earlier than any affirmation of a bounce. This offers you higher risk-reward since your cease can sit tight at 4,195, providing a 10-point threat for a possible 40-point reward.

Late Entry Strategy:

You anticipate affirmation—maybe a robust rejection candle off 4,200 assist or clear shopping for quantity earlier than coming into at 4,210. Your cease would possibly must be wider at 4,190, however you have got larger confidence the extent will maintain.

Right here’s how these approaches sometimes evaluate in range-bound markets:

By way of Optimus Futures’ superior order administration system in Optimus Circulation, you'll be able to arrange bracket orders for each approaches. The important thing perception comes from monitoring the DOM panel for order move exhaustion and using the platform’s quantity evaluation to establish when giant orders are being absorbed at key ranges, though that is purely an academic commentary and never buying and selling recommendation.

Essential Rule: Keep away from buying and selling in the midst of the vary the place path is unclear. Stick with the perimeters the place the possibilities are in your favor.

Technique 2: Quantity Profile Mastery

This technique separates newcomers from intermediate merchants, however don’t fear—it’s simpler to grasp than it sounds.

Disclaimer: It is a hypothetical situation for academic functions solely. Previous efficiency will not be indicative of future outcomes. Buying and selling futures entails substantial threat of loss.

Think about the Micro E-mini NASDAQ (MNQ) buying and selling between 15,800 and 16,200 for 2 weeks. Utilizing Optimus Circulation’s free quantity evaluation instruments, you'll be able to establish what merchants name the “Level of Management”—primarily the worth stage the place most buying and selling exercise happens.

Let’s say this stage is at 16,000. Your technique turns into easy: when costs transfer to the extremes of the vary (16,180 close to resistance), you search for alternatives to commerce again towards the high-volume space at 16,000.

Optimus Circulation’s Energy Trades characteristic takes this a step additional by highlighting when giant institutional orders are being executed in real-time. This helps you notice accumulation at assist ranges earlier than bounces happen, or distribution at resistance earlier than reversals—although keep in mind, these are academic observations solely.

Technique 3: Breakout Preparation and Quantity Warnings

Skilled merchants know that sideways markets don’t final without end. Finally, one thing offers means, and when it does, the strikes could be doubtlessly explosive. The bottom line is recognizing the warning indicators earlier than the breakout happens.

Disclaimer: The next instance is for academic functions solely and shouldn't be construed as buying and selling recommendation. Market circumstances can change quickly, and previous patterns don't assure future outcomes.

Take into account the E-mini NASDAQ (NQ) consolidating between 14,500 and 15,000. Seasoned merchants put together for the eventual breakout by waiting for these indicators:

Quantity Spike Warning System: Optimus Circulation’s quantity evaluation instruments assist you to spot when quantity all of the sudden will increase close to vary boundaries. This typically indicators both a real breakout or a “entice transfer” the place establishments are testing the waters. Once you see uncommon quantity at 14,480 assist or 15,020 resistance, it’s time to concentrate.

Vary Tightening Indicators: Observe the vary because it step by step narrows over time. If NQ begins buying and selling between 14,600 and 14,900 as an alternative of the unique 14,500-15,000 vary, strain is constructing for a major transfer.

Place Sizing for Compressed Volatility: In tight ranges, volatility is compressed, so alter your place sizes accordingly. You would possibly think about buying and selling a smaller dimension through the vary section, then growing your place dimension when the breakout truly happens.

The bottom line is place sizing—by no means threat greater than 1%-2% of your account on every path(opinion). Optimus Circulation’s Market Replay characteristic allows you to backtest how comparable setups have traditionally carried out, offering confidence in your method with out risking actual cash.

Superior merchants make the most of Optimus Circulation’s TPO Profile evaluation to establish the place costs have spent essentially the most time, which helps predict the path the eventual breakout would possibly favor.

The Expertise Benefit

Why Optimus Circulation Makes the Distinction

What separates profitable sideways market merchants from the remaining typically comes right down to having the correct instruments. Optimus Circulation supplies a number of options which are significantly priceless for range-bound buying and selling.

The limitless simulation surroundings helps you to follow these methods utilizing actual market information with out risking precise cash.

The Market Replay characteristic permits you to backtest your concepts utilizing historic tick-by-tick information, so you'll be able to see precisely how your methods would have carried out.

For Optimus Futures prospects, the platform features a free buying and selling journal with automated commerce synchronization. This implies each commerce will get logged routinely, serving to you monitor your efficiency and establish what’s working and what isn’t.

The Time & Gross sales panel shows each commerce being executed in real-time, enabling you to grasp the order move at key assist and resistance ranges. Historic Time & Gross sales allows you to analyze particular value bars and perceive how markets sometimes react at vary boundaries.

The Working Orders panel retains monitor of all of your pending trades, whereas the Positions panel supplies real-time revenue and loss info. These could sound like superior options, however they’re designed to be intuitive sufficient for newer merchants whereas refined sufficient for professionals.

Setting Up Your Futures Buying and selling Platform

Platform Configuration Made Straightforward

Necessary Disclaimer: All examples and techniques mentioned are for academic functions solely. Buying and selling futures entails substantial threat of loss and isn't appropriate for all traders. Previous efficiency will not be indicative of future outcomes.

Getting began with range-bound market buying and selling on Optimus Circulation doesn’t require a level in pc science. The platform organizes every part into logical classes that make sense.

Right here’s a easy setup course of that works for each newcomers and skilled merchants:

- Analytics Panels: Arrange your most important chart with a number of timeframes (1-hour and 5-minute work nicely for ES/NQ buying and selling) and add the Time & Gross sales panel for real-time order move monitoring

- Buying and selling Panels: Configure your Working Orders panel for managing pending trades and the Positions panel for real-time P&L monitoring

- Danger Administration: Allow the automated Buying and selling Journal and arrange customized alerts for key assist and resistance ranges

- Workspace Structure: Prepare your major chart displaying the 1-hour timeframe with clear assist and resistance ranges, a secondary 5-minute chart for exact entries, and place your order administration panels the place you'll be able to simply monitor them

The Greater Image

Balancing Alternatives and Challenges

Sideways market buying and selling provides clear benefits: you get well-defined entry and exit factors, decrease publicity to in a single day hole threat, and techniques that work nicely with smaller account sizes. Nevertheless, it additionally presents challenges, together with larger transaction prices from extra frequent buying and selling and the necessity for lively monitoring.

Right here’s how the important thing advantages and challenges break down, together with how Optimus Futures addresses every concern:

| Profit | Problem | Optimus Futures Answer |

|---|---|---|

| Clear entry/exit factors | Increased transaction prices | $0.25 micro futures commissions |

| Decrease publicity to hole threat | Time-consuming monitoring | Customized alerts and notifications |

| Predictable revenue targets | Danger of false breakouts | Free DOM Floor for order move evaluation |

| Appropriate for smaller accounts | Requires lively administration | Free Cellular App for on-the-go buying and selling |

The bottom line is understanding that false breakouts will occur and having the self-discipline to stay to your threat administration guidelines after they do.

Your Subsequent Steps

Sideways markets will not be obstacles to keep away from—they’re alternatives to embrace. With clear methods, disciplined threat administration, and professional-grade instruments like Optimus Circulation from Optimus Futures, range-bound durations can turn out to be a constant supply of potential buying and selling alternatives.

The bottom line is preparation, endurance, and disciplined execution. Whether or not you’re a newbie studying the fundamentals or an skilled dealer seeking to refine your method, the methods and instruments mentioned right here will help you navigate sideways markets with higher confidence.

Able to navigate sideways markets? Open an account with Optimus Futures, begin with our free simulation surroundings, and follow your methods utilizing Optimus Circulation. Once you’re prepared, execute with confidence utilizing our professional-grade platform and complete brokerage companies.

Necessary Danger Disclaimers:

Futures buying and selling entails substantial threat of loss and isn't appropriate for all traders. The excessive diploma of leverage that's typically obtainable in futures buying and selling can work in opposition to you in addition to for you. Previous efficiency will not be indicative of future outcomes. All examples and techniques mentioned on this article are for academic and illustrative functions solely and shouldn't be construed as buying and selling suggestions or funding recommendation.

The position of contingent orders, corresponding to stop-loss orders, won't essentially restrict your losses to the meant quantities, since market circumstances could make it unattainable to execute such orders. Please commerce rigorously and at your individual discretion.

[ad_2]