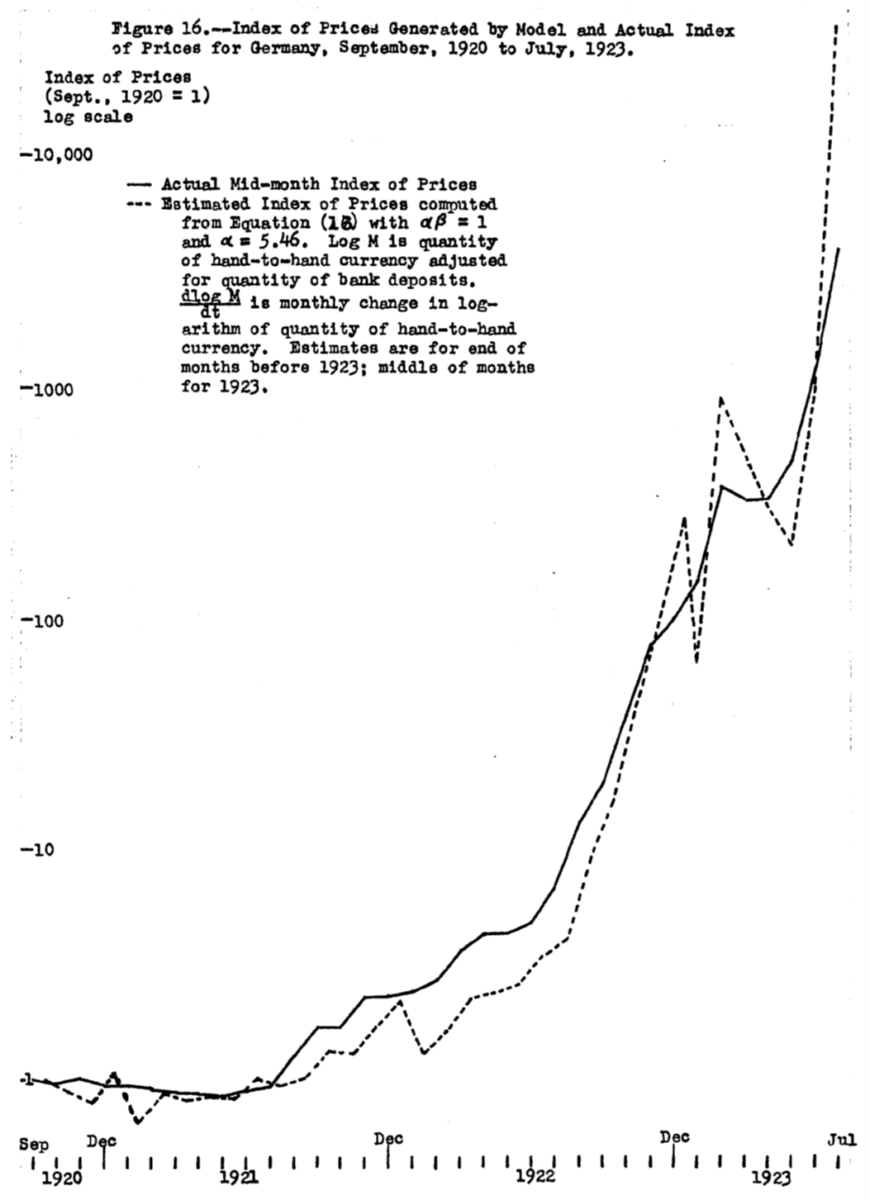

I used to be fascinated about how a very subservient central financial institution can destroy value stability, referring to examples from historical past. From Phillip Cagan’s U.Chicago dissertation:

Supply: Cagan (1954). Notice: Drawn on a log scale.

Based on Cagan’s calculations (Desk 10), as of August 1920, m/m inflation (annualized) was 30.7% (utilizing log variations). By August 1921, it was 153%; by August 1922, it was 337%.

In different phrases, one can get quickly accelerating inflation if financial coverage is totally untethered in a scenario the place there are huge price range deficits, and the central financial institution is performing utterly on the discretion of the fiscal authority (i.e., what the present assault on the Fed is aiming at).

For FY2026, given the passage of OBBB, the price range deficit will possible be 7% of GDP (in comparison with 5.5% underneath the prior present legislation). That is basically a structural price range deficit worth, provided that the financial system is close to full employment.