[ad_1]

Inventory Market Outlook getting into the Week of July thirteenth = Uptrend

- Common Directional Index: Uptrend

- Institutional Exercise: Uptrend

- On Steadiness Quantity: Uptrend

ANALYSIS

The inventory market outlook exhibits a seamless uptrend for U.S. equities.

The S&P500 ( $SPX ) fell 0.3% final week. The index sits ~5% above the 50-day transferring common and ~7% above the 200-day transferring common.

All three technical indicators stay bullish after a decrease quantity consolidation in the course of the week.

SPX Value & Quantity Chart for July 13 2025

PERFORMANCE COMPARISONS

Power ( $XLE ) outperformed the market index, whereas Communications and Financials ( $XLC & $XLF ) underperformed. Client Staples ( $XLP ) continues to battle discovering a course, falling again to bearish bias.

S&P Sector Efficiency from Week 28 of 2025

Most sector types struggled final week; Excessive Beta ( $SPHB ) outperformed, Momentum ( $MTUM ) underperformed. Low Beta ( $SPLV ) slipped again to impartial bias.

Sector Model Efficiency from Week 28 of 2025

Bitcoin rallied greater than 8%, as cryptocurrencies soared final week ( e.g. $ETHE , $OSOL ) main asset class returns listed beneath. Gold ( $GLD ) was surprisingly quiet, given the outperformance seen by different metals like copper and palladium ( $CPER & $PALL ). Bonds ( $IEF ) continued their latest slide decrease. Sadly, these strikes recommend inflationary pressures, none of which helps the case for price cuts. No adjustments to bias versus final weekend.

Asset Class Efficiency from Week 28 2025

COMMENTARY

Within the absence of main macroeconomic headlines, U.S. tariffs took middle stage. 14 nations acquired up to date tariff “letters”, starting from 25% to 40%, with a brand new implementation date of August 1. Markets took the bulletins in stride; simply the newest escalation within the ongoing commerce warfare.

However over the weekend, the U.S. introduced 30% tariffs on the European Union and Mexico; odds are it will provoke extra of a response from markets when futures buying and selling opens Sunday night.

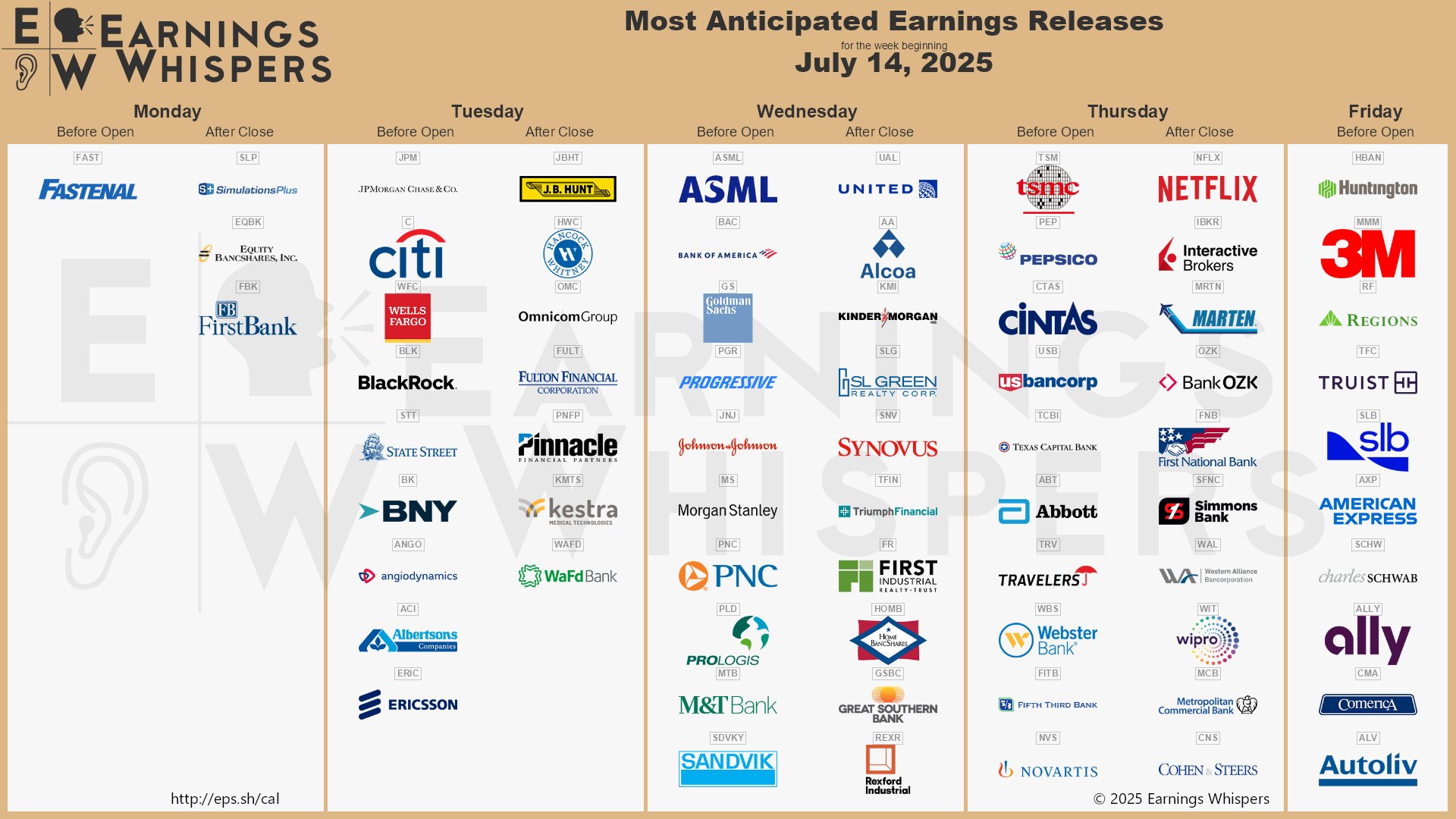

Along with extra tariff headlines (we’re nonetheless ready on China), the newest inflation readings ( CPI & PPI ) are launched this week, together with retail gross sales and housing figures. Earnings season additionally kicks off, with monetary establishments reporting second quarter outcomes and offering their insights into the remainder of 2025.

Greatest to Your Week!

P.S. In case you discover this analysis useful, please inform a pal.

In case you don’t, inform an enemy.

Sources: Bloomberg, CNBC, Federal Reserve Financial institution of St. Louis, Hedgeye, Stockcharts.com, TradingEconomics.com, U.S. Bureau of Financial Evaluation, U.S. Bureau of Labor Statistics

Make investments Safely, LLC is an impartial funding analysis and on-line monetary media firm. Use of Make investments Safely, LLC and another merchandise obtainable via invest-safely.com is topic to our Phrases of Service and Privateness Coverage.

Not a suggestion to purchase or promote any safety.

[ad_2]